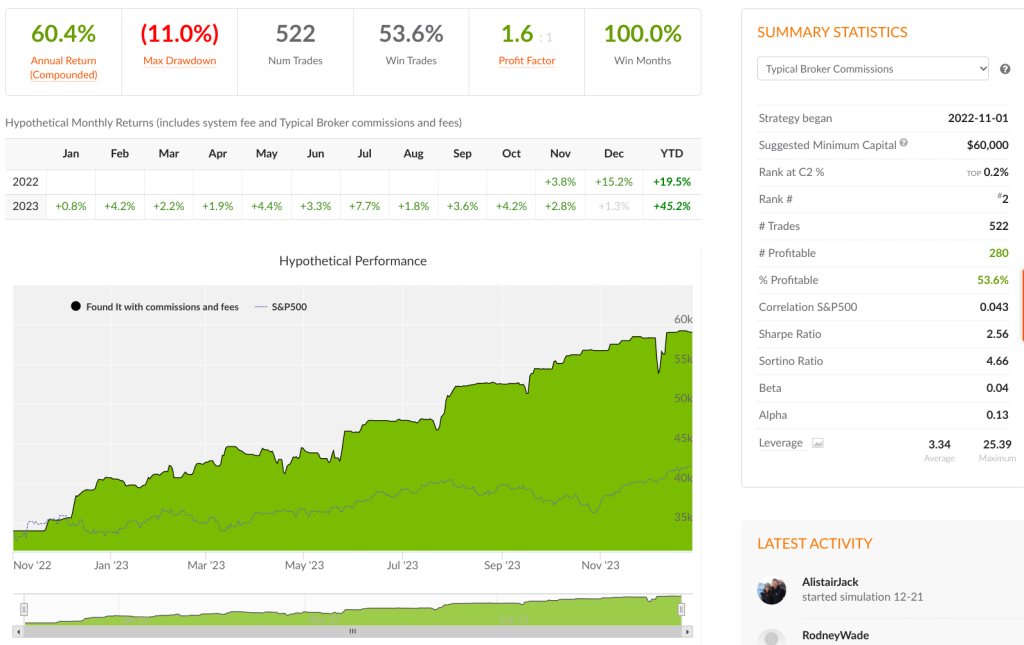

Days like today can be stressful. After hitting a high of $631,754 in my personal IBKR accounts six days ago, they are down to $595,848 in a string of three losing days. That is an average daily loss of $12,000 or 1.9% a day about three times worse than the market!

The desire to jump out can be high in moments like this. After all I have had such a good run since September when the accounts were at just $461,000 as shown in the image below. But it is important to ignore this impulse to trade based on recent return. It is better to only sell when the algorithms have a trigger.

This persistent myth and desire of high returns with low volatility does great damage to a our ability to obtain either. Over and over again it is shown that active traders, hedge funds, and professionals are not good at beating a simple index fund strategy. So why should I bother trading?

It is my view that to beat a market you must take on more risk than said market. If I want to beat the long-term total return of 0-3 month treasury bills the worst way is to go buy individual 0-3 month treasury bills. The best way statistically is to go invest my money in a higher risk asset assuming I am willing to accept higher volatility and remain invested longer.

In regards to the stock market one can do this by buying stocks with higher betas, purchasing options, using leverage via futures, leveraged etfs, margin loans, etc. These are all ways to take on more risk and have different pros and cons. One can try beating the market with stock picking but any success is likely due to luck or holding a higher average beta portfolio.

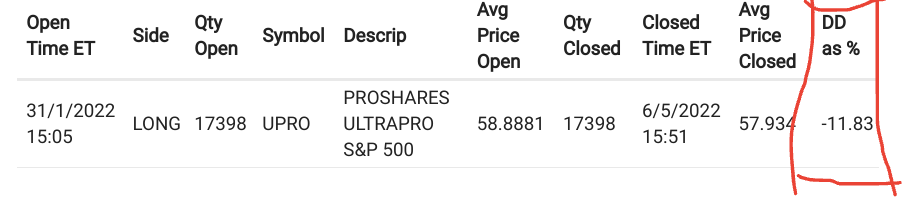

Generally I think technical analysis is unable to give you higher rates of return in the long run all else and in particular beta being equal. If you trade only SPY there is little chance that after taxes and fees you will be able to beat SPY total returns over a decade. However, if you trade UPRO (3X SPY) and use some risk mitigation techniques I think you can beat SPY in terms of total returns, but regardless of what your max draw down is you most certainly took more risk. Just because something worked out doesn’t mean you didn’t take more risk.

It is best to accept that it is impossible to predict what the next days market result will be. How ridiculous would I be if I thought I could predict the outcomes of a fair dice roll beyond the prophecies of statistics. How arrogant would I have to be to think I could predict the market better than the millions of professionals with billions of dollars under management.

This is why I believe it is best to mostly remain invested and just absorb the 3% down days etc. However, this doesn’t mean no trading should occur! There are two main reasons to make a trade.

- Better Opportunity: If we are in stocks but according to the historical statistics bonds offer a better average daily return under x,y,z metrics then it is best to sell some stocks and buy some bonds.

- Elevated Portfolio or Market Risk: Imagine you play a game where every correct coin flip you get a dollar and every wrong one you lose 50 cents. If your money hits zero you are done. If you start playing this game with $100 in reserve it is an easy money maker. If you start playing with only $1 it would be pretty easy to lose. Sometimes the risk can be too high because of market conditions. Sometimes the risk can be too high due to portfolio positions. Likewise if I were using $100 but the games metrics changed to earn $10 or lose $9 it may be best to take a pause.

My algorithms are getting closer and closer to having some sell signals for some of the portfolios, but I am not going to exit just because I had a 6% drawdown while using 3X ETFs. This is to be expected.

Disclaimer

This is not investment advice for you. This website is designed to talk about investments but it is not designed to give you personalized investment advice. This site contains generic information that does not have the capability of taking your personal risk tolerance, goals, assets, or other factors into account. Therefore, this site and all of its related content is for entertainment, informational, and educational purposes only.

The owner of PatienceToInvest.com is also a trade leader on Collective2.com. We may receive compensation by promoting some collective2 strategies over others. Should you decide to make or avoid any investments or use any service due to the information on this site or related information you assume full responsibility and risks and will not hold howiinvest.com it’s associated sites or its owners responsible. You also acknowledge investing is risky and can result in the loss of all your capital and even more than your original capital in some cases.