The primary problem with Collective2 has nothing to do with the site. I think the website is quite wonderful as it provides a place for traders and investors to be discovered and make some extra money. The problem is that users and developers let their greed and impatience lead to bad investing. I know not only because I have seen others do this, but because I have done the same thing.

My hope is that this blog will be a good place to talk about how leaders and subscribers can make collective2.com a more effective and profitable place. Unfortunately, I know most of my advice will fall on deaf ears. Don’t forget to subscribe to see future posts.

When I first Started

I first found Collective2 sometime around 2017. I am thankful to collective2 for a number of things. It introduced me to volatility trading and has given me an outlet for countless hours of research.

Over the five years of following Collective2 and running strategies on it for part of that, I have seen so many strategies come and go. The vast majority of strategies don’t last more than 3 years, and the vast majority of subscribers jump from one strategy to another burning themselves until they leave the site. I don’t have internal data. This is just my projection based on what I have seen.

Recent Performance is Worthless

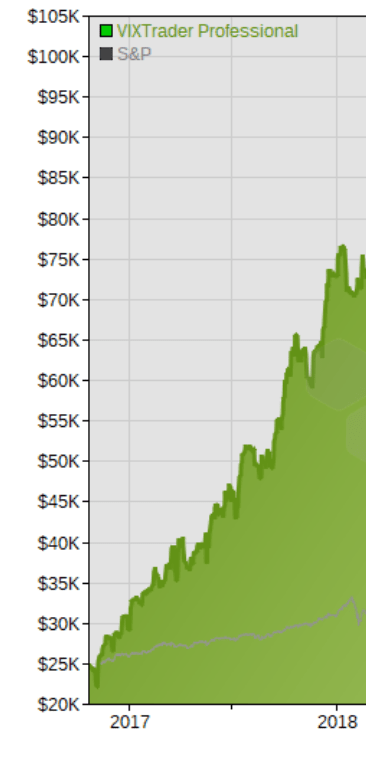

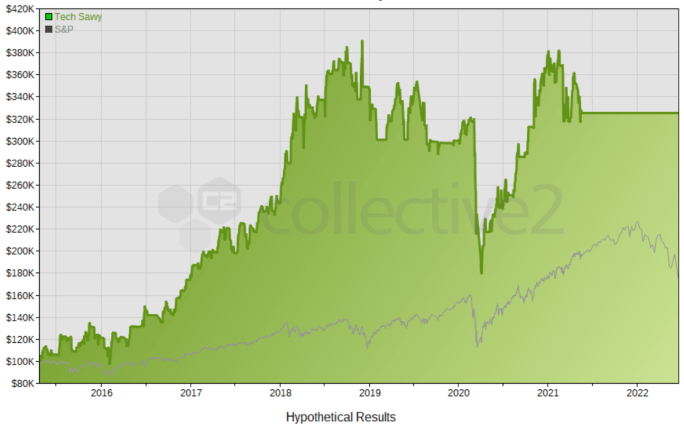

If you select your investment strategies based on recent performance you are bound to fail in the long run. When I first started VIXTrader Professional (ID 106600099) was by far one of the best performing and most popular strategies. Today it has virtually no followers and has been made private. This is by no means unique to this particular strategy. This is a pattern I have seen over and over again. So for today’s post all I want to say is don’t make your investment selection on C2 based on recent performance. Even a fantastic five year performance is not a good selection metric (see Just Forex Below). There are much better selection metrics, and I will discuss them in further posts.

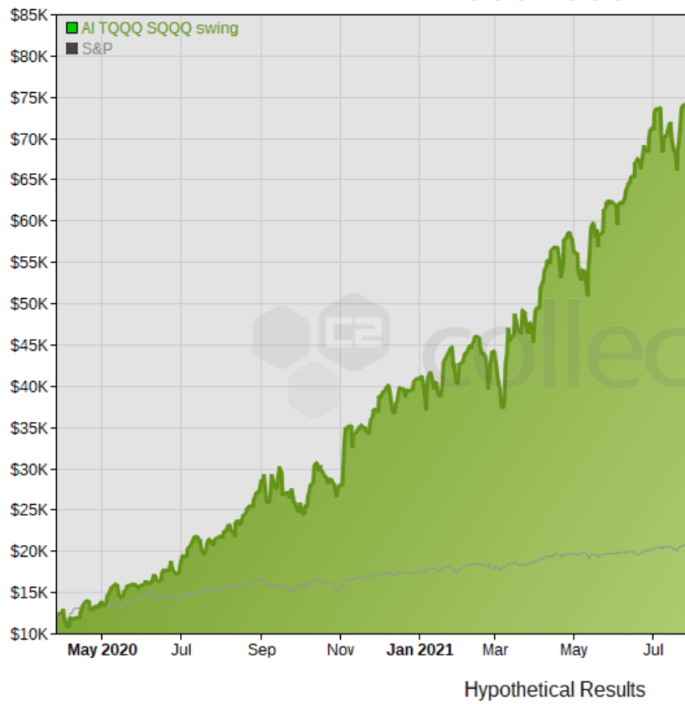

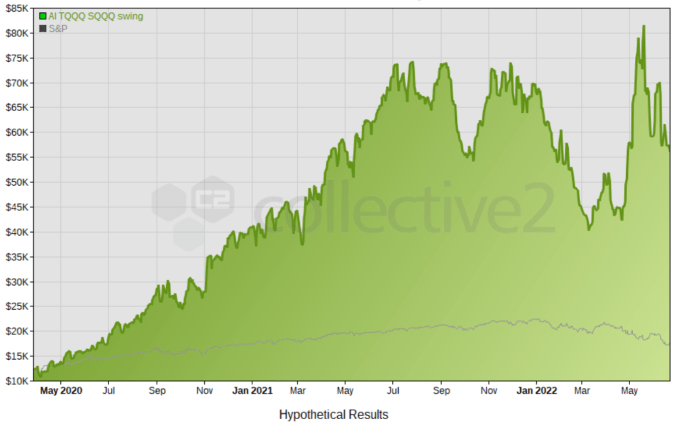

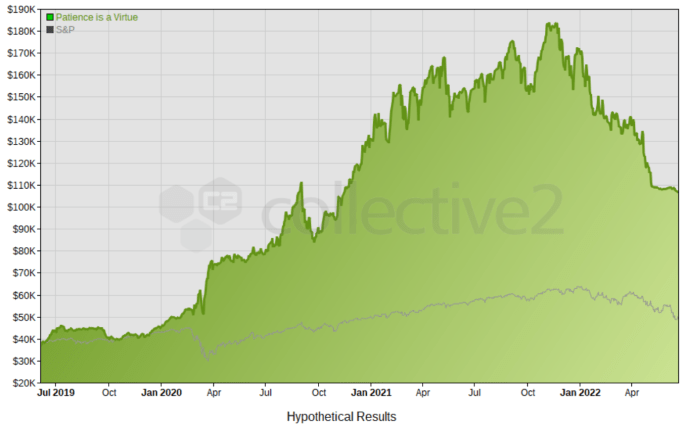

For now, simply drill it into your head that picking a strategy based on good performance over the last 1, 2, 3, 4, or even 5 years is not a good method. Check out some of the strategies below and see how great they looked. Then click to see the next picture of how that strategy has done since that period.

The last strategy Patience is a Virtue is my main strategy that follows my Roth IRA. It has had a horrendous year. I am by no means impervious to a drawdown, but I will discuss in future posts why I still think it is the best spot for me to keep my own money.