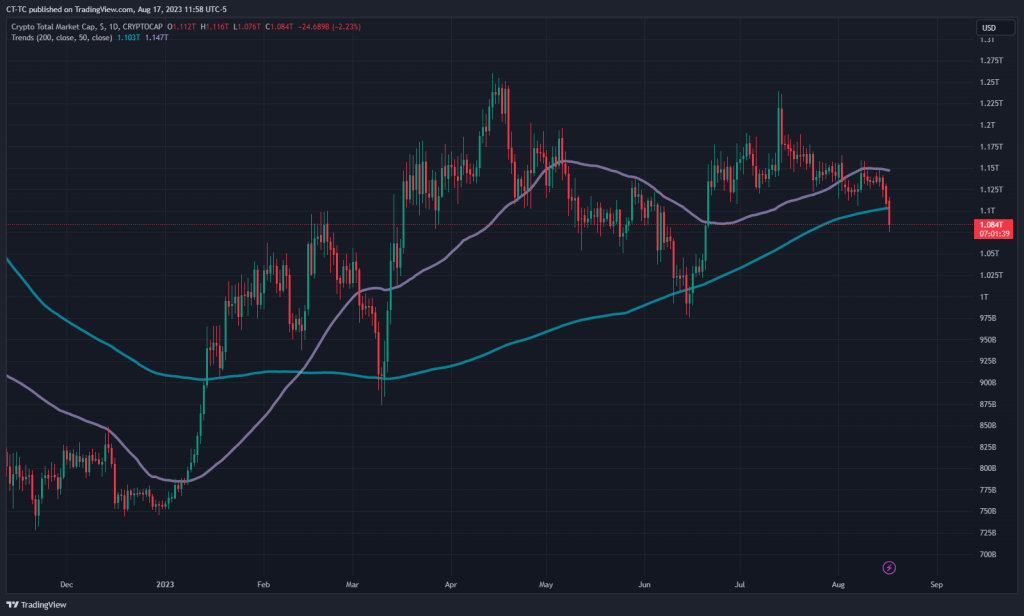

Crypto has taken quite the hit in the last few days. I certainly find myself unsure of where it will go next. The portion of my crypto that I have designated as America doomsday insurance I am just hanging on to and haven’t made any changes. The algorithmic portion of my portfolio that trades BITO has been out completely since it sold its last shares on August 10th, 2023 at $15.21 avoiding the roughly 10% drop since.

I have been tempted though to open another position in crypto within my portfolio that is my discretionary entry and exit section. In general I think crypto isn’t going away and when drops like this happen it does seem like a decent buying opportunity. I don’t have much in terms of free cash on hand at the moment. Though I am very familiar with options I don’t trade them frequently. So I’m going to double dip here and open a small options position on BITO in one of my small taxable accounts.

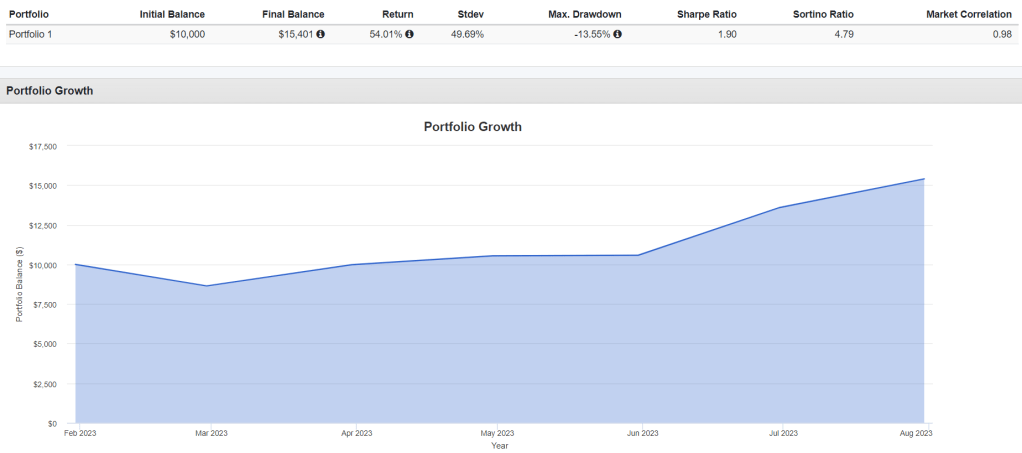

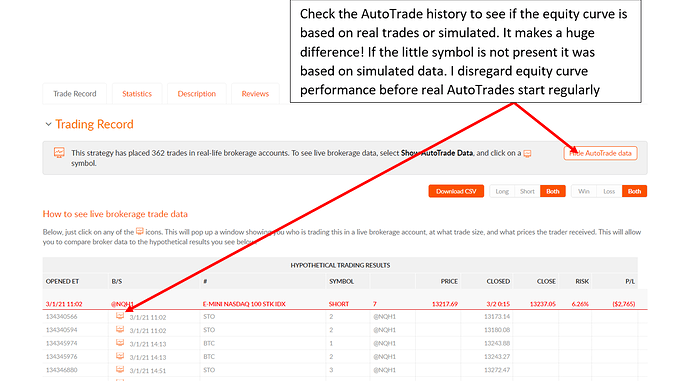

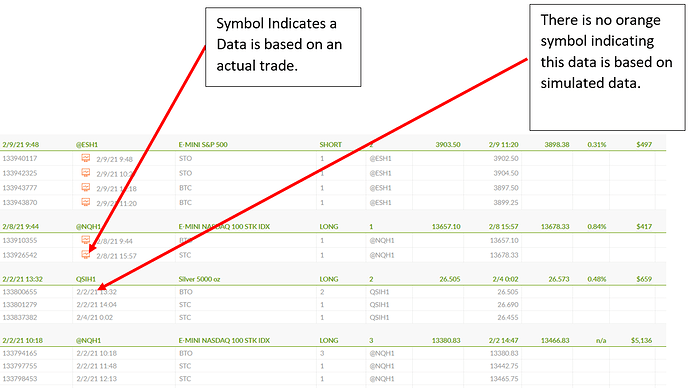

This isn’t a trade that is going to be recorded in my collective2 strategies because I am doing it in a very small roughly $10,000 taxable account that C2 doesn’t track.

This is almost more of a experiment and silver lining trade. I don’t want to miss out completely on this dip buying opportunity but don’t want to go in big, because I just really don’t know what will happen with crypto in the coming months.

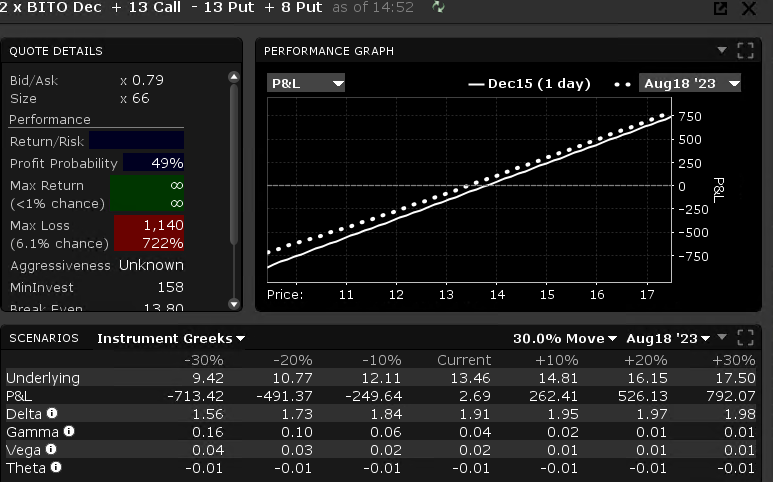

The first position is designed to be a play that I can leave open until expiration without even thinking about it through December. The max loss of $1,140 is something I can live with. At that point I would be more disappointed about my buy and hold crypto portfolio which is larger than this.

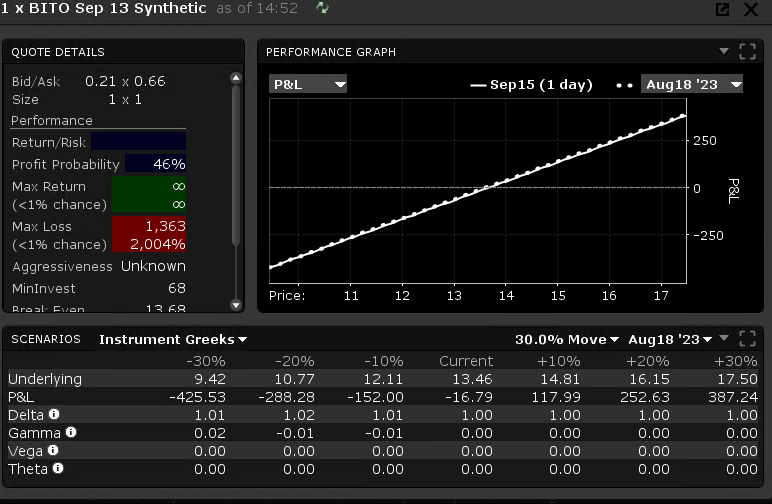

The second play is designed to similarly be a loss I can live with but I gave it a shorter window to move.

These will be interesting to watch, but the truth is I really have no idea what direction BITO will take or how fast, but I am bullish on BITO in the long-run so I would say based on that the average day I can expect a positive move. Hopefully this period is a good period for crypto.

Disclaimer

This is not investment advice for you. This website is designed to talk about investments but it is not designed to give you personalized investment advice. This site contains generic information that does not have the capability of taking your personal risk tolerance, goals, assets, or other factors into account. Therefore, this site and all of its related content is for entertainment, informational, and educational purposes only.

The owner of PatienceToInvest.com is also a trade leader on Collective2.com. We may receive compensation by promoting some collective2 strategies over others. Should you decide to make or avoid any investments or use any service due to the information on this site or related information you assume full responsibility and risks and will not hold howiinvest.com it’s associated sites or its owners responsible. You also acknowledge investing is risky and can result in the loss of all your capital and even more than your original capital in some cases.